Step 2. Learn what particular challenges SMEs face when trading across borders and the reasons for these challenges

Market access challenges

Many factors affect the lower rate of participation of SMEs in international trade. There are internal constraints of higher vulnerability to market developments and high infrastructure costs, as well as lower productivity, including a lower level of digitization (*1).

In addition, SMEs are disproportionally affected by trade barriers and inefficiencies resulting from trade policy, namely standards and technical regulations, logistics processes and services, and customs and other administrative trade procedures.

| Trade Barriers for US SMEs The US International Trade Commission investigated of trade barriers for SME in the EU market in 2014 (*2). The findings pointed at the following cross-cutting trade barriers: Standards related measures resulting in high compliance costs in particular for chemicals and cosmetics but also for machinery and technical equipment;High tariffs and quotas for agriculture products including corn, wheat, lamb and poultry.Difficulties involving trade secrets and patenting costs; andLogistics challenges including customs requirements.Logistics challenges include difficulties with the Harmonized System (HS) classification because of difference in HS classification by EU MS and frequent incidences of delays due to re-classification. Other issues are the complexity and document and reporting requirements of the EU VAT system, and unreliable domestic distribution services. SMEs stated that these factors make it difficult for them to assess landed costs for the customers, increases their risks of additional costs, and reduces their competitiveness. |

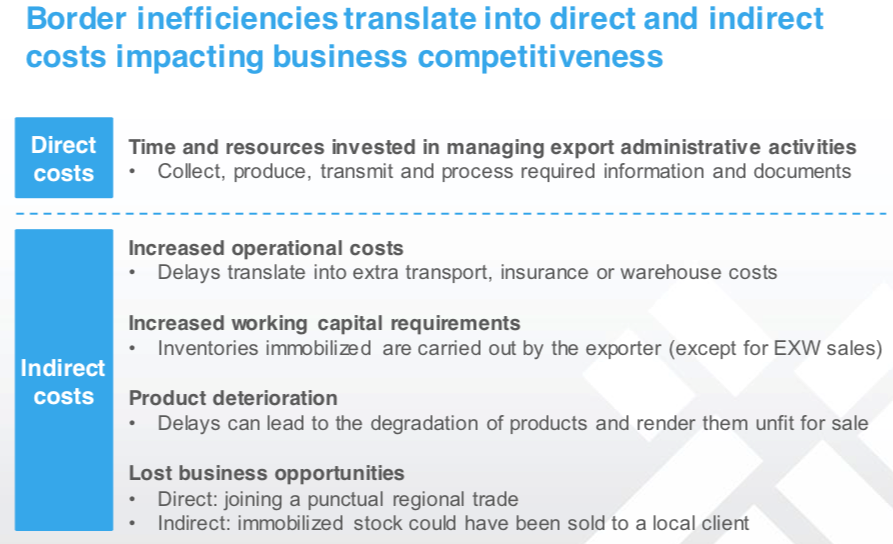

Trade and border procedures translate into direct and indirect costs for businesses and impact firms competitiveness. SMEs disproportionately bear the burden of these barriers.

Why are SMEs disproportionately affected by these barriers?

Complying with regulatory requirements and adapting to regulatory variance across countries is more difficult and costly for SMEs compared to larger firms. They have comparatively higher regulatory compliance costs because of:

- Less in-house knowledge of applicable regulations and laws;

- Fewer dedicated resources for managing import / export processes;

- Lower level of digitialization of internal processes and documents;

- Less amount of capital available for investments in infrastructure and equipment;

As a result, screening, navigating and complying to different regulatory requirements is often too costly and time consuming for SMEs, in particular when they operate in an opaque business environment where access to information is difficult and corruption ripe.

SMEs therefore either do not engage in international trade or incur additional costs. They hire external advisors and contract international shipping or logistics companies that offer worldwide services and specific market knowledge and limit financial and logistics risks for the SMEs.

Hence, SME’s ability to access international markets is more limited and vulnerable to framework conditions in which they operate. Trade facilitation may strengthen their capability to participate in international trade as it aims to bring down the cost and time to trade .

(*1) OECD (2017) Enhancing the Contributions of SMEs in a Global and Digitalised Economy, page 31, OECD Publishing, Paris

(*2) US ITC (2014) “Trade Barriers that U.S. Small and Medium-sized Enterprises Perceive as Affecting Exports to the European Union”, Investigation No 332-541. Publication 445, (ITC, March 2014)